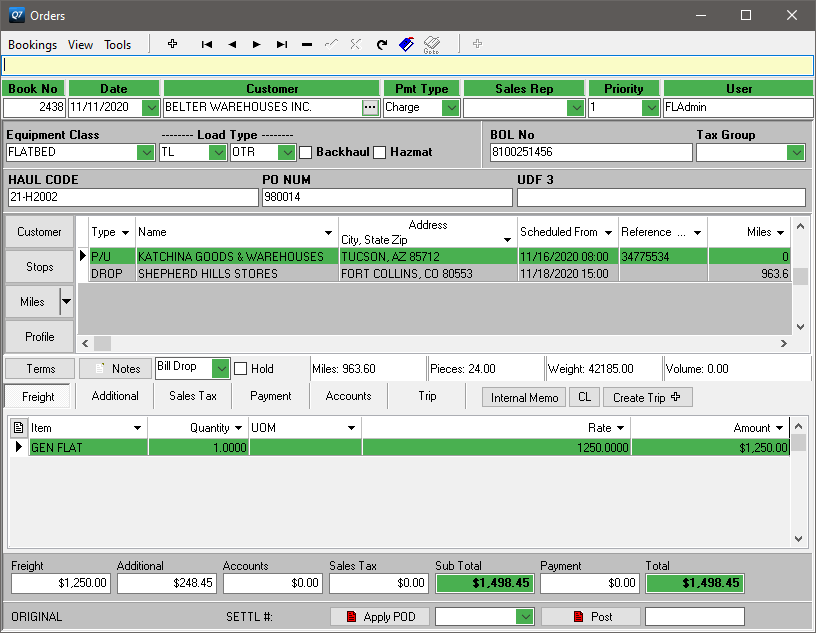

Order Management

Order Management is at the center of Q7 dispatch and accounting functions. It's a true single-entry system - entering an order once makes it available to dispatch, billing, pay and appropriate accounting functions. Orders can be entered manually or imported from load tenders using the optional EDI component.

Accommodates multi-stop loads and allows charges to be billed by the mile, weight, flat, piece or volume. Built-in rate charts permit automatic calculation of customer charges including fuel surcharges.

Included is a powerful freight quotation system that's ideal for freight brokers or anyone else interested in building a comprehensive customer quote database. Quotations can be emailed (optional), faxed or printed and can be converted to live orders.

A fast and flexible duplication provision allows for replicating an order or quotation. Great for commodity haulers or anyone running repeated lanes.

See It Work!

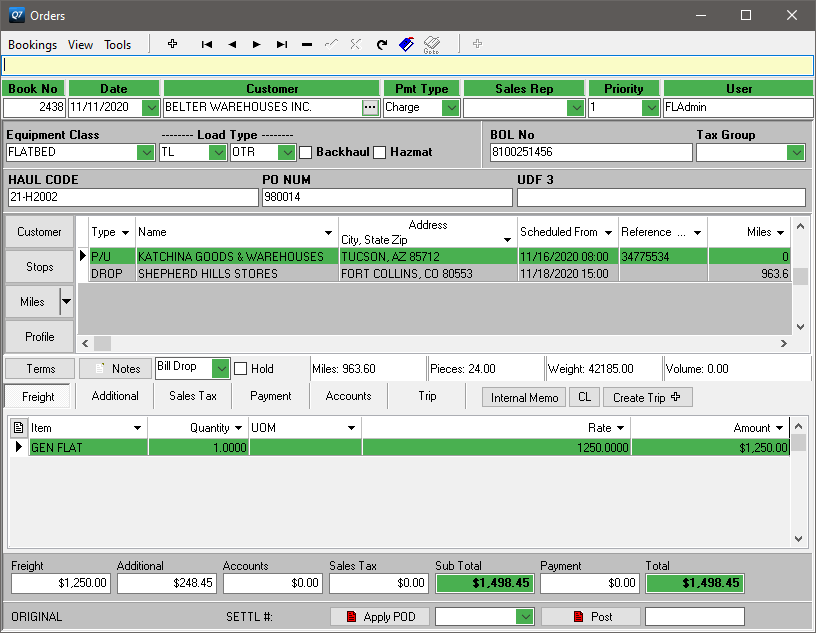

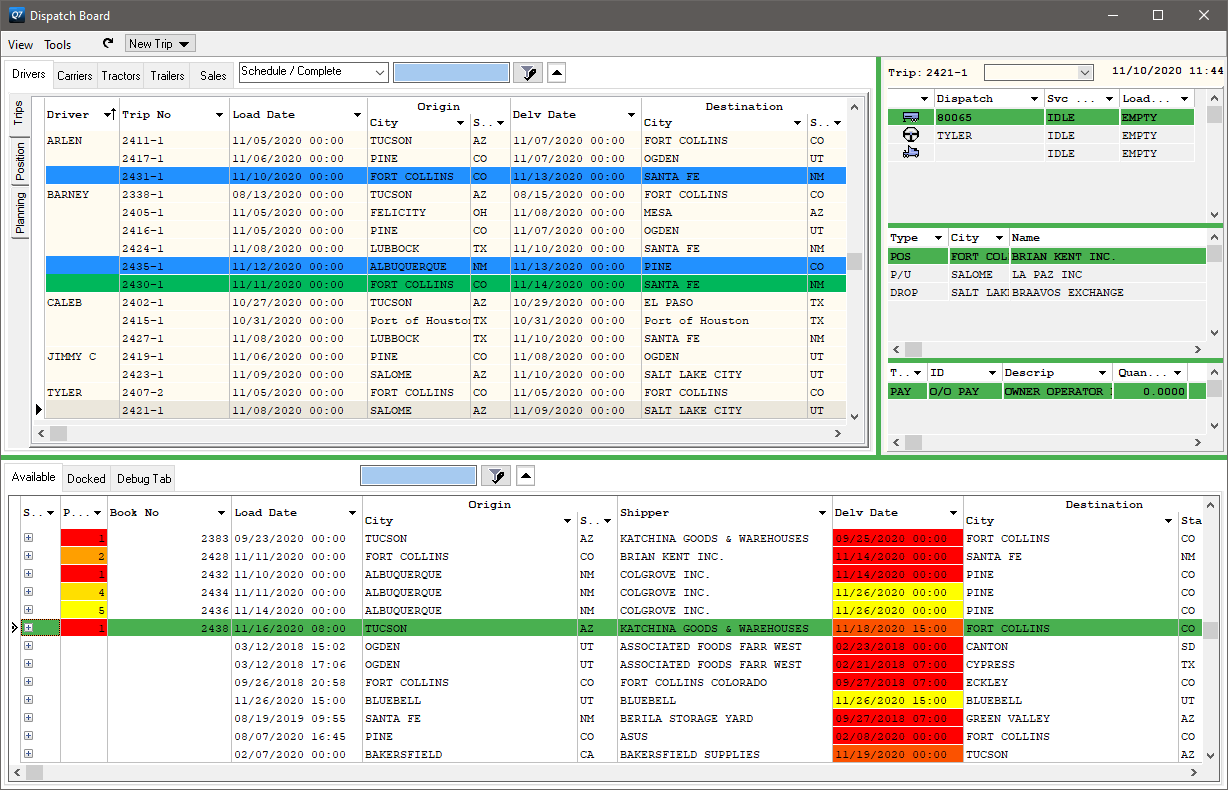

Truckload Dispatch

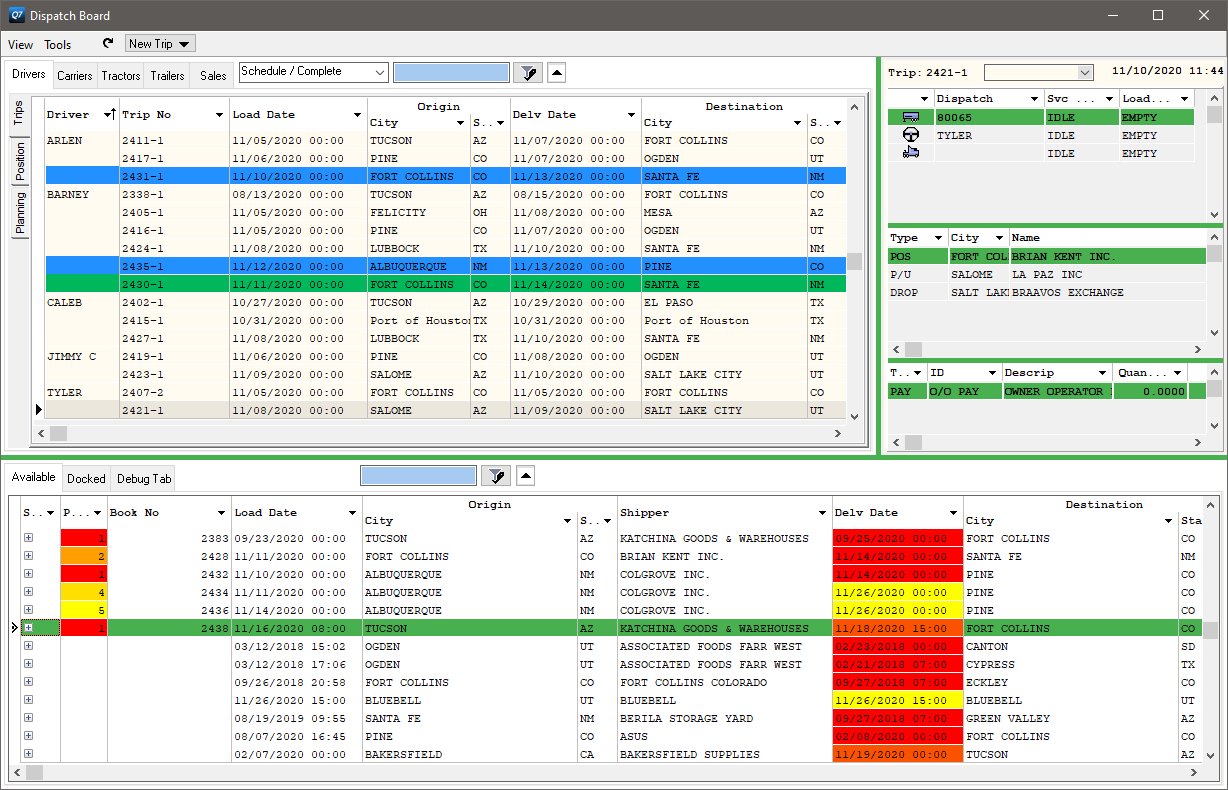

Q7 Trucking Dispatch Software is the control center for all truckload planning and dispatch activities. It's fully customizable and complete with capabilities that handle even the most challenging dispatch scenarios.

Advanced load planning provisions allow you to quickly match loads to trucks, pre-assign loads, track out-of-service for drivers and equipment and manage driver schedules.

Truckload Dispatch maintains and displays current positions of tractors, trailers (including pools), carriers and drivers. Check calls can be posted manually or via GPS systems for real-time accuracy.

Color coded safety notifications warn of approaching or expired safety dates, keeping your drivers and equipment moving.

See It Work!

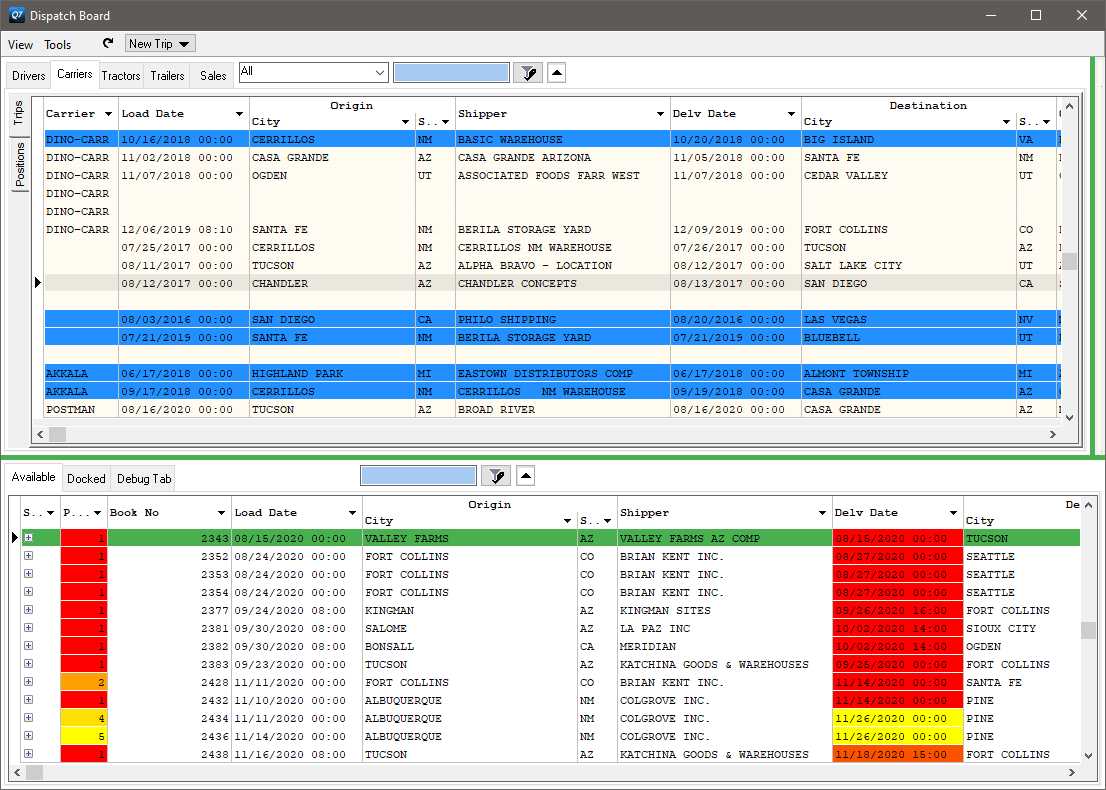

Brokerage Dispatch

Q7 Brokerage Dispatch Software is the control center for all freight brokerage planning and dispatch functions. This comprehensive freight broker software is fully customizable and complete with capabilities that handle even the most challenging dispatch scenarios. User-friendly dispatch console displays up-to-the-minute status of load progress and provides instant access to customer and carrier contact information.

Carrier insurance, SAFER status, contract on file and other critical carrier qualification data is maintained and directly linked to Brokerage Dispatch. Load assignments to unqualified carriers can be denied or allowed based on your business rules.

A comprehensive search provision lets you quickly identify the best carrier for a particular load. Isolate the carrier providing service for a designated lane along with pay rates, revenue and trailer availability.

Professional looking carrier confirmations detail load specifics including pickup and delivery times, directions and pay. Load Confirmations can be customized to the format of your choice and emailed (optional) or faxed directly to the carrier.

See It Work!

LTL Dispatch

Q7 Dispatch Software is the control center for all LTL planning and dispatch activities. It's fully customizable and complete with capabilities that handle even the most challenging dispatch scenarios.

Features LTL cross docking, ideal for applications where local pickups are consolidated and manifested for outbound dispatch. A detailed trip manifest can be printed or emailed (optional) directly to the driver.

Advanced load planning features allow you to quickly match loads to trucks, pre-assign loads, track out-of-service for drivers and equipment and manage driver schedules.

LTL Dispatch includes provisions for tracking current positions of tractors, trailers (including pools), carriers and drivers. Check calls can be posted manually or via GPS systems for real-time accuracy.

LTL Dispatch is seamlessly connected to driver and equipment safety statistics. Color coded warnings of approaching or expired safety dates keep drivers and equipment moving.

See It Work!

Freight Billing

Q7's Freight Billing component produces professional looking customer invoices that can be emailed (optional), printed or faxed. Supports single and batch invoicing and allows invoices to be customized using the built-in report editor.

Sales reporting tools include analysis and control reports that provide up-to-the-minute sales information by customer, invoice number and sales category.

The optional Document Imaging system allows proof of delivery documents to be scanned and included with customer invoices.

See It Work!

Pay Settlement

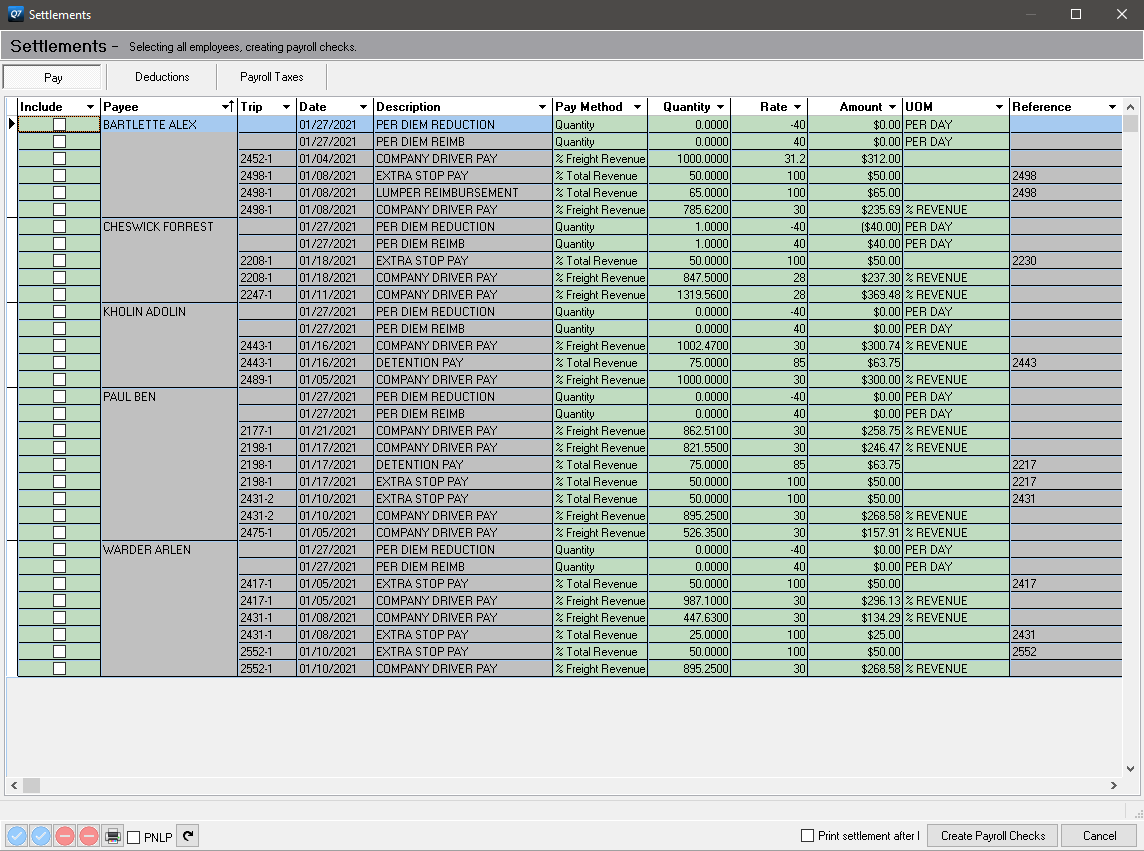

Q7 Pay Settlement gives you complete control over carrier and driver pay processes, allowing you to choose what to pay and when. Handles pay to company and contract drivers as well as carriers and salespeople.

Supports pay by the mile, revenue, flat, piece or volume. Can automatically apply fuel, advance and repair deductions and has the ability to include recurring deductions such as insurance, 401k and garnishments.

Concise driver settlement sheets provide your drivers and carriers with an easy to read summary of pay, deductions and reimbursements. You can email (optional), fax or print settlements and re-print them at any time. Settlements can be customized to your specific needs using the built-in report editor.

See It Work!

Fuel and Mileage

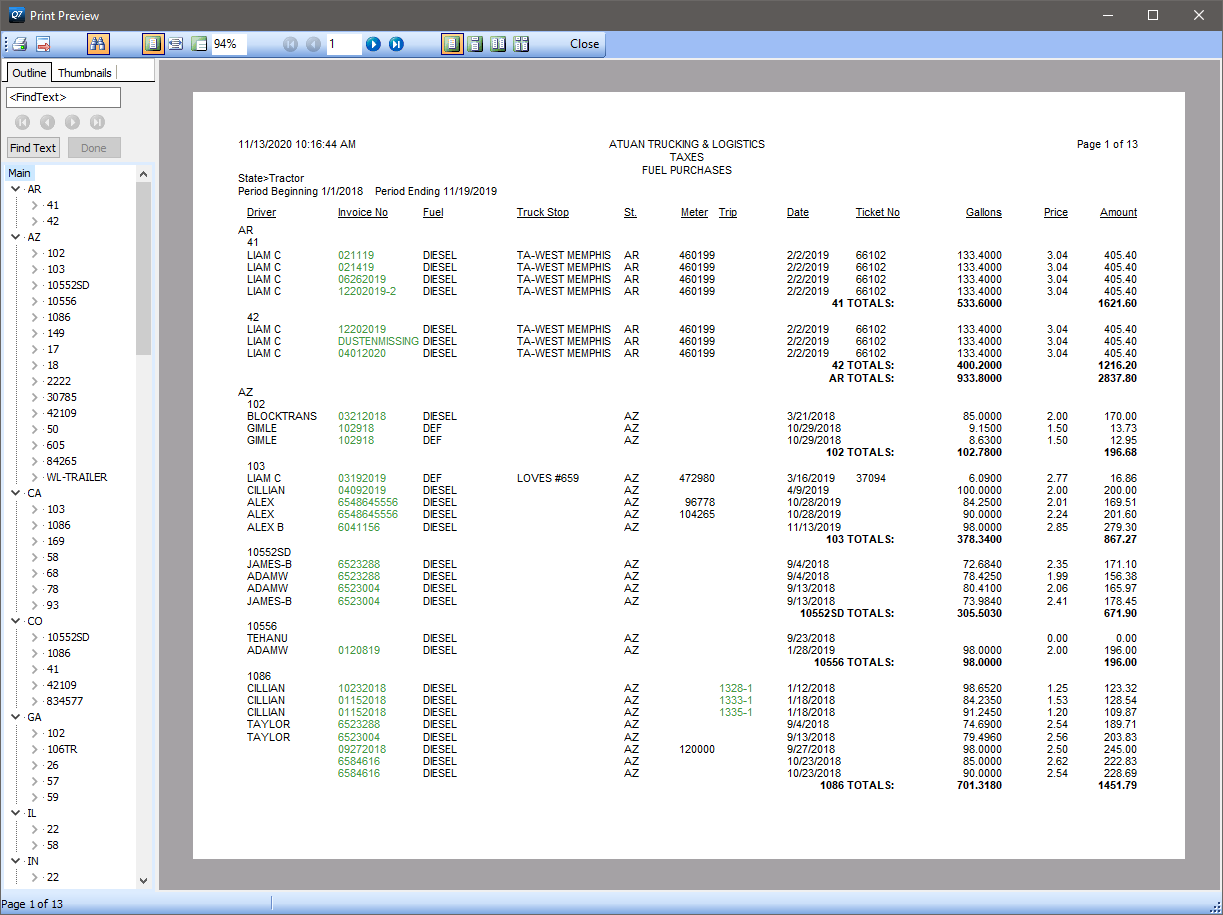

Fuel purchases can be entered manually or imported from any of the popular fuel card services using the optional Fuel Card Interface. Driver deductions are created automatically for applicable fuel purchases and cash advances. Fuel costs are tracked by driver, tractor and trip.

Detailed truck mileage records are maintained for regulatory and analytical purposes. State mileage can be entered manually or generated with the optional Mileage Interface. Tracks odometer readings and provides cross-check to state mileage totals.

The IFTA Tax Report, Mileage Report, Tractor MPG and Fuel Purchases Report make quarterly fuel tax preparation quick and easy.

See It Work!

Fleet Maintenance

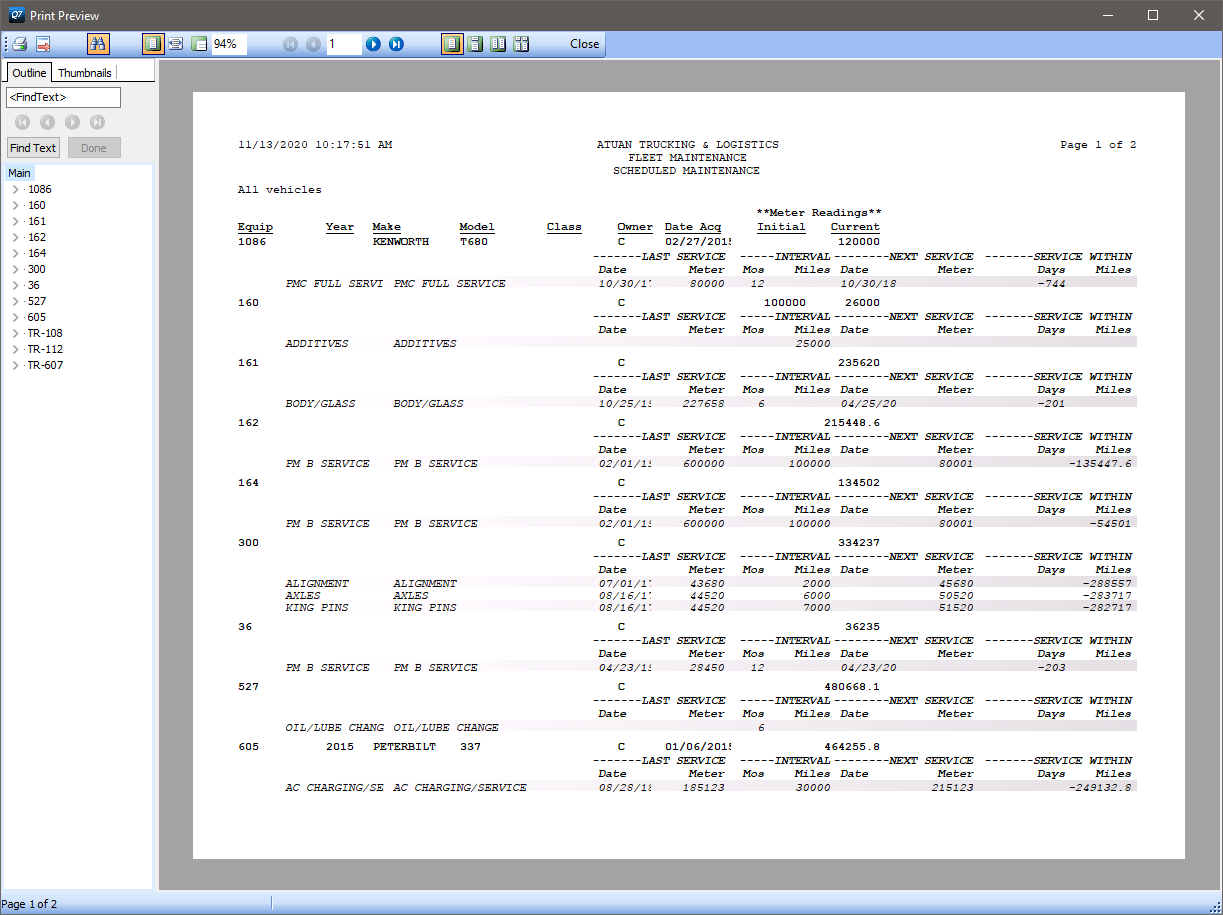

Q7 Fleet Maintenance includes a detailed equipment profile that tracks key information about tractors, trailers and other fleet assets. Identity, specifications, registration, maintenance and insurance data are available instantly when you need it.

A comprehensive repair order system manages shop and road-work repair costs by unit number, category and driver. Also allows estimates and billing of repairs to outside customers with automated parts markup.

Maintenance schedules help keep your fleet current, avoiding costly emergency repairs. The system notifies you, in advance, when routine maintenance services are required. Maintenance schedules can be triggered by miles and/or time and are able to be copied across multiple units.

The built-in inventory system tracks part activity including on hand levels, cost, usage, reorder points and suppliers. Shop inventory is automatically adjusted as repair orders and purchases are processed. Supports actual and average inventory costing methods and includes a provision for making inventory adjustments.

See It Work!

Safety

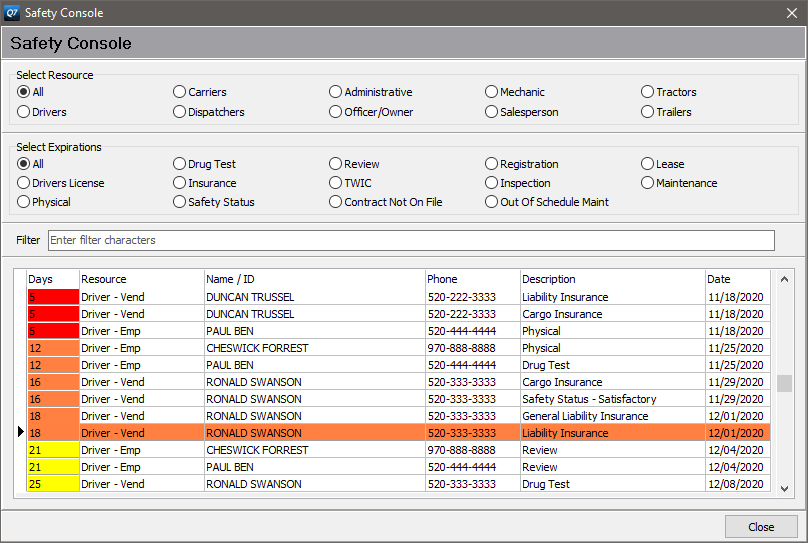

Q7 maintains and reports critical driver, carrier and equipment safety and compliance information including license, reviews, drug tests, physicals, authority, insurance, registration and more. The system alerts dispatch operations of upcoming expirations and other safety issues.

Driver, carrier and equipment safety reports help you head off costly down time due to a safety violation. Reports include Driver and Vehicle Safety Report, Safety Notifications, Insurance, Registration and Inspection Reports.

See It Work!

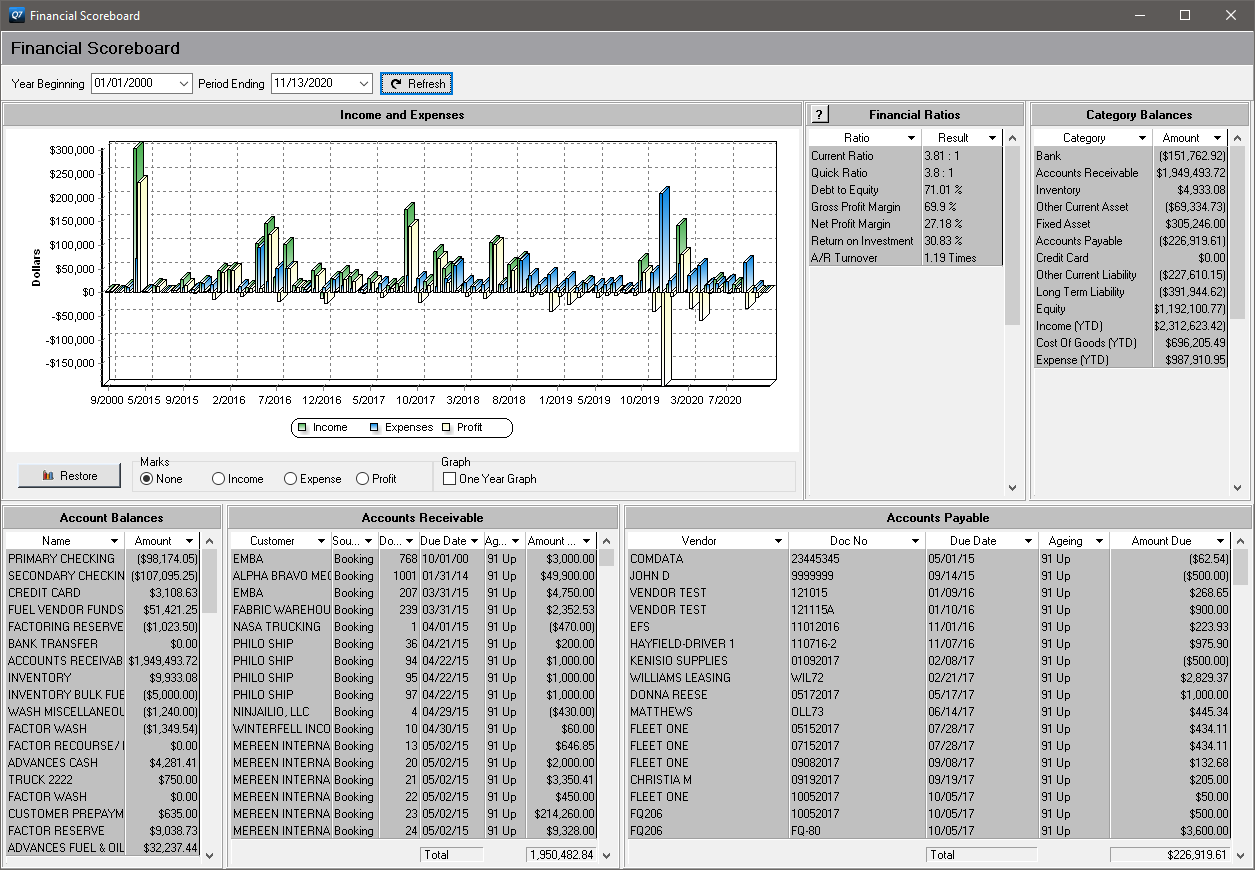

Accounting

ACCOUNTS RECEIVABLE

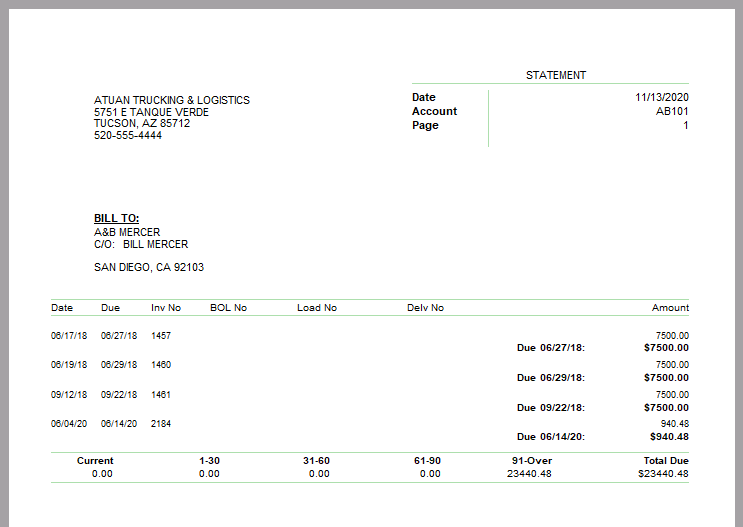

Q7 Accounts Receivable tracks customer invoices, payments and account adjustments. Instantly query customer's current balance and credit limit. Print or email (optional) customer statements, with interest on past due accounts. Respond to credit requests quickly using the Customer Credit Report and project cash flow with the Aged Account Report. Also included are Balance Due, Sales Journal and Account Transaction reports.

ACCOUNTS PAYABLE

Take control of company expenditures with Q7 Accounts Payable. Designed exclusively for trucking, it allows you to create purchase orders, track vendor invoices, pay bills and project cash flow. Handles recurring expenses including loan payments. Print or E-File mandatory Form 1099s for carriers, drivers and suppliers. Complete with Purchases Journal, Account Balance and Aged Account reports.

BANKING

Q7 Banking includes a flexible check writing system for issuing operating and payroll checks, or remitting payments electronically using the optional Direct Deposit module. View cash transactions by bank account, void checks, create deposits and transfer funds. A bank reconciliation feature lets you balance your bank accounts quickly and accurately and it accommodates multiple bank accounts.

GENERAL LEDGER

Q7 includes a full featured General Ledger with corporate Income Statement, Balance Sheet and Trial Balance with year to date comparisons and department reporting capabilities. Also provided is an efficient general journal entry system and account auditing reports.

See It Work!

Payroll

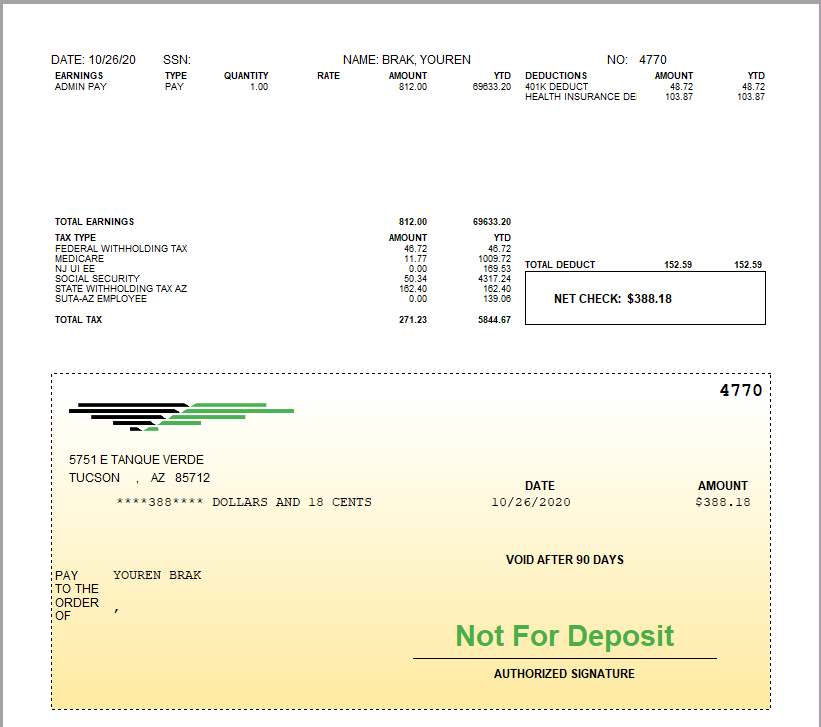

Q7 Payroll includes a detailed employee profile which tracks name and contact info, applicable taxes, deductions and other key personnel data. Sort, search, filter and reporting tools allow you to access employee information quickly and efficiently.

Accommodates hourly, salary, mile, percent of revenue and flat pay methods. Handles recurring employee deductions and tracks tax exempt deductions such as health insurance and 401k plans. The Payroll Journal provides detailed and summary reporting of all payroll transactions.

A sophisticated payroll generation system puts you in control of who to pay and when. Generate payroll checks or issue ACH and EFT payments. Permits single and batch processing of employee payroll and multiple bank accounts are supported.

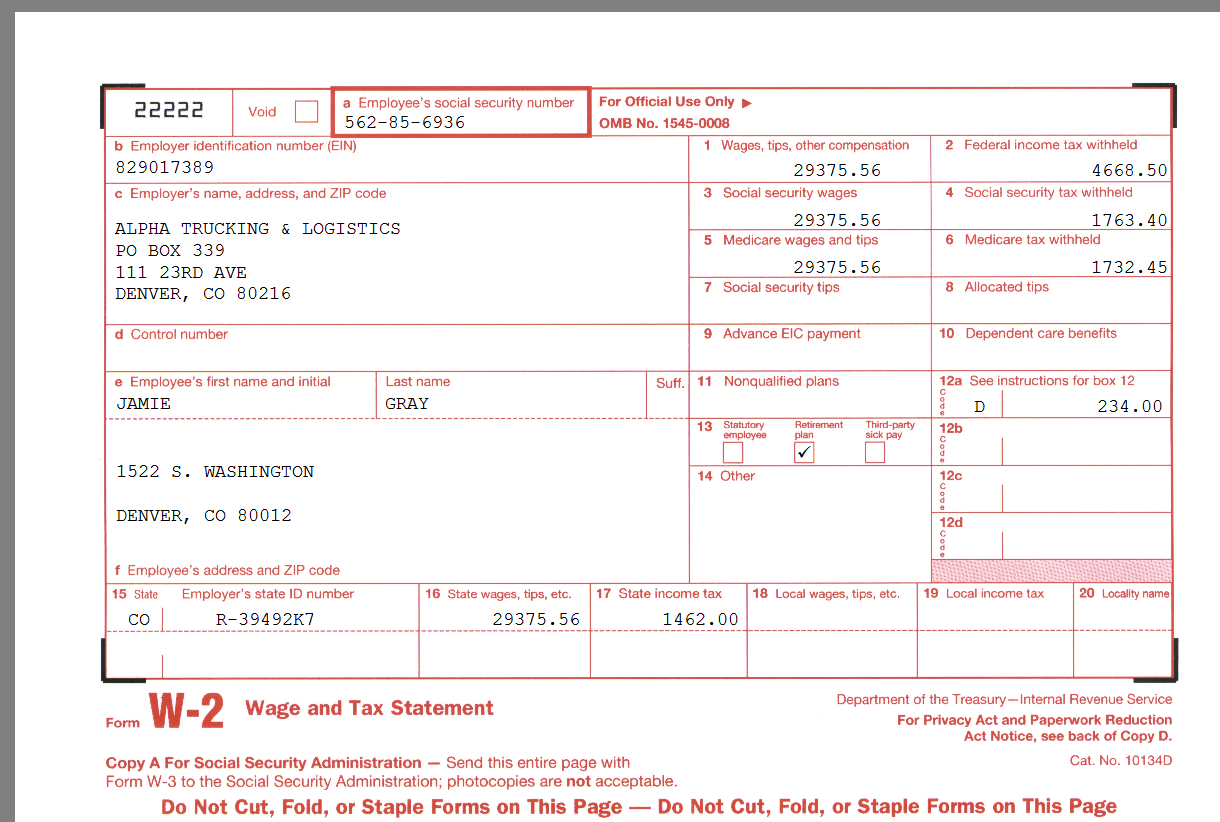

Print or E-File employee Form W2s. The Federal 941 Summary, Payroll Audit and Unemployment reports provide what you need for Federal and State payroll tax reporting.

See It Work!

Management Reporting

Q7 Management Reporting includes a wealth of reports that allow you to analyze operations profitability by customer, driver, carrier, tractor and trailer. Evaluate revenue, profit per mile, carrier cost, fuel, repairs and more.

Corporate income statement, balance sheet and visual snapshots of key operations and financial statistics keep you informed of the big picture.

Every report is 100% customizable using the built-in report editor. In addition, if you need a report that's not already built in, Q7 allows you to generate custom reports from scratch using the optional Data Export component.

See It Work!

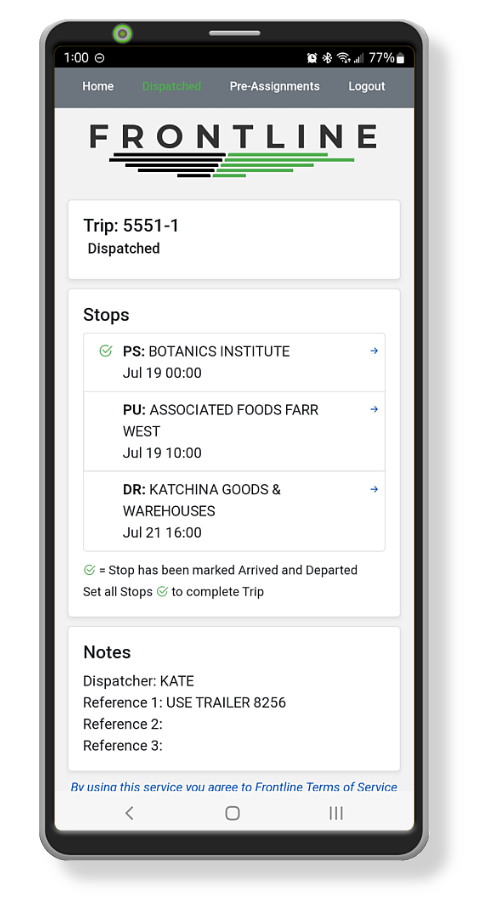

Driver Mobile App

Q7 Drivers is Frontline's in-house driver mobile application.

Drivers see their current Trip, upcoming Pre-Assignments, automate Stop Arrivals, Departures, and more.

See It Work!